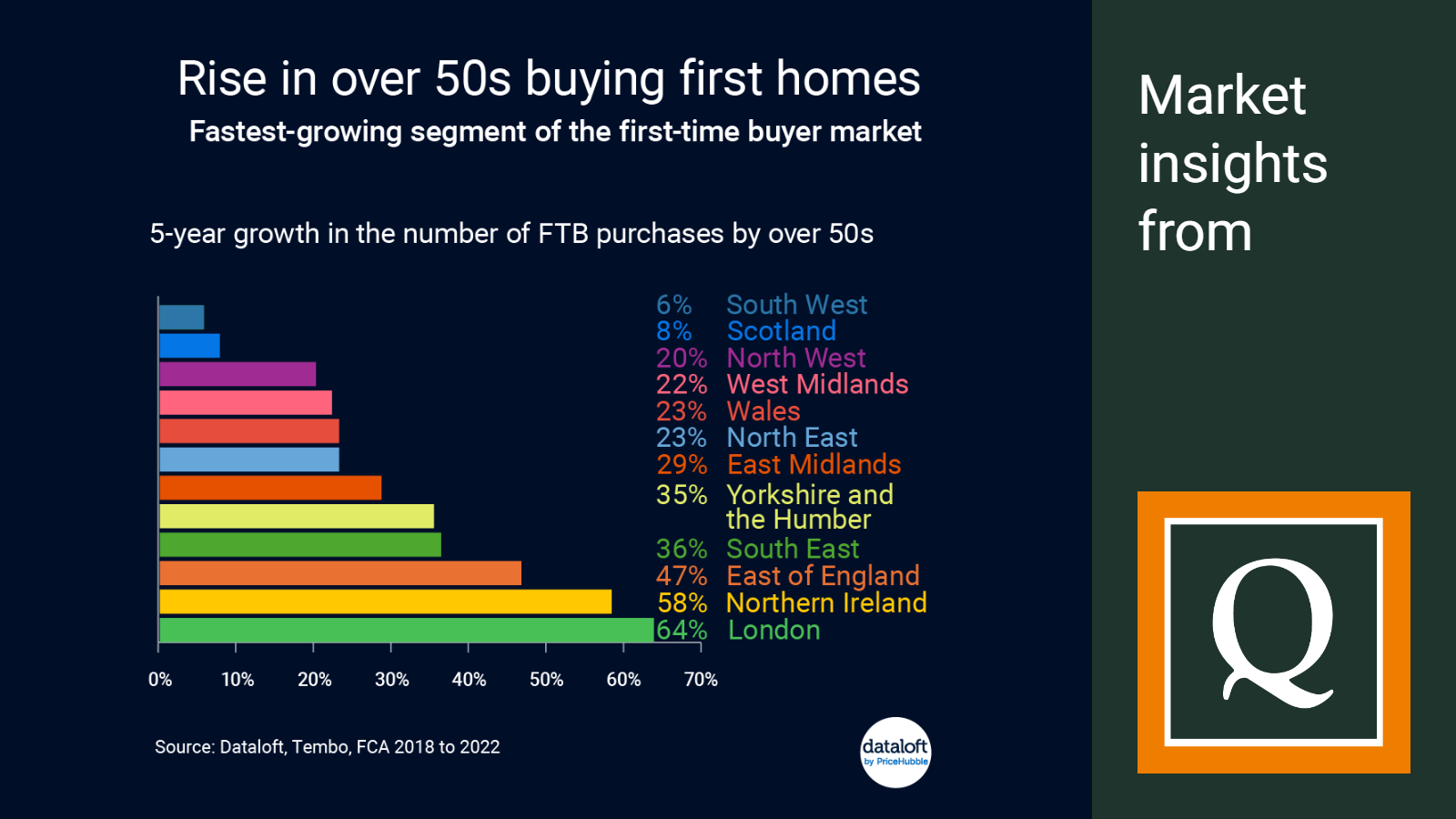

A demographic curveball has revealed itself in the recent surge in first time homeownership among those over 50 years old. With an increase of more than 30% in the past five years, this age group is bucking the trend and rewriting the traditional narrative in the UK property market.

While younger individuals typically drive the archetype of first-time buyers (FTBs), the reality is that the proportion of those aged 30 and under on the property ladder is in decline.

This shift poses intriguing questions and insights into the evolving dynamics of the housing market, affordability, and later-in-life milestones. Whether you're an enthusiastic property market observer, a potential home seller, or someone contemplating venturing into homeownership, this trend deserves a closer look.

Affordability: The Game-Changer For FTBs

The primary catalyst behind this shift is an issue that resounds widely: affordability. The decision—or necessity—to postpone such a significant financial commitment until one's fifties underscores the broader economic pressures and changes in societal norms.

The strain on FTB affordability underlies a truth that owning a home is no longer a rite of passage to the early adulthood years.

London's Market: A Microcosm Of Change

London, a city renowned for its exorbitant housing prices, stands at the forefront of this trend. It currently has the lowest proportion of first-time buyers over the age of 50, yet the trend is accelerating the most rapidly.

Between the years 2018 and 2022, purchases from the over-50 cohort have grown by an astounding 64% in London.

What This Means For The Property Market

This shift has multiple implications:

- Property Types Demand: There might be a shift in the types of properties in demand, as older FTBs may have different needs and preferences compared to their younger counterparts.

- Financial Products Adaptation: Mortgage lenders and financial institutions may need to adapt their products to cater to older buyers who might be approaching the age of retirement.

- Market Accessibility: Efforts may be directed towards making the market more accessible to younger buyers through policies and programs that address the root challenges of affordability.

- Seller Strategies: Home sellers might adjust their marketing strategies to appeal to a broader age range, including the rising numbers of FTBs over 50.

The Landscape For FTBs

For aspiring homeowners of all ages, it's more important than ever to stay informed, seek financial advice, and consider the full spectrum of what modern homeownership entails.

Remember, whether you're 30 or 50, buying for the first time means stepping into a new chapter with optimism and knowledge as your guides. If you're among those wanting to make this leap later in life, take heart in knowing you are part of a growing trend.

Are You Looking For Your First Home In Kent?

If you’re ready to make a move and are looking for an experienced and knowledgeable estate agent in Sittingbourne, Sheerness, Minster, Faversham, Canterbury, Rainham, Gillingham, Chatham, Rochester or Maidstone to help guide you through the process, we’re here to help.

Contact Quealy & Co, your local, independent estate agent in Sittingbourne today to learn more about how we can assist with your property search and make the moving process as smooth and stress-free as possible. We look forward to working with you!

Call us 01795 429836 or email hello@quealy.co.uk to chat with a member of our friendly and experienced team.

Source: #Dataloft, Tembo, FCA 2018 to 2022

Other Stories

17 November 2025

Fresh Wave of Housing Approved in Medway as Investment Surges

15 November 2025

The Christmas Markets In Kent Everyone Is Talking About

28 October 2025

Renting with Pets: What Kent Landlords Need to Know

28 October 2025

by

by