As your trusted independent estate agent in the Sittingbourne area, Quealy & Co bring you the very latest property market updates in their regular blog posts. Why not register with us to ensure you receive our monthly newsletter and don’t miss out on the very latest news on house prices and moving home tips!

Another base rate increase, but what does it mean?

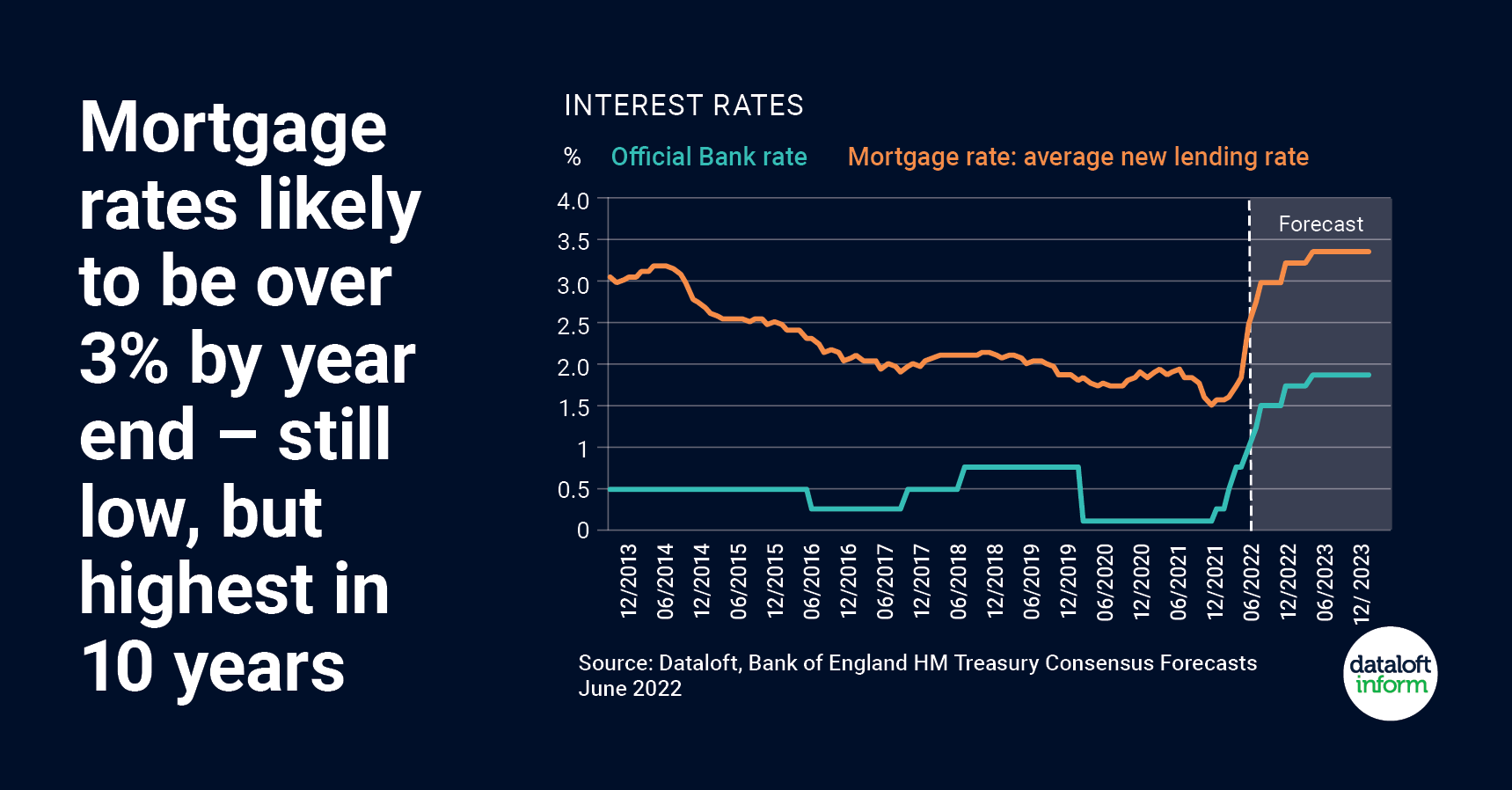

With inflation running high, the Bank of England increased its base rate to 1.25% in June, with another 0.5 percentage point rise forecast before the end of 2022 and potential for a further 0.25 percentage point rise in 2023.

The typical margin between mortgage rates and the bank rate (1.5 percentage points over the last year) suggests the average new lending mortgage rates will be over 3% by the end of 2022.

The vast majority of new mortgage borrowers are on fixed rates (representing 92% of new loans over the last 5 years) offering protection from rising payments, at least until the fixed term expires.

House prices are largely driven by what people can borrow and at what cost, so with rising rates this does start to drive affordability the wrong way.

Do you need advice about your mortgage?

With the changing financial landscape, it is an excellent time to discuss your mortgage options with our independent financial advisors. Their advice is free and without obligation and they will ensure you are on the best mortgage deal for your circumstances. So whether your term is coming to an end or your are buying a property in Sittingbourne, Sheerness, Minster, Faversham, Canterbury, Rainham, Gillingham, Chatham, Rochester and Maidstone, get in touch with our friendly team at Quealy.

Call us on 01795 429836 or email hello@quealy.co.uk to chat with a member of our friendly and experienced team about anything to do with moving home.

Source: Dataloft, Bank of England HM Treasury Consensus Forecasts June 2022

Other Stories

23 January 2026

Ski-In, Ski-Out Living at L’HÉRITAGE, Morzine

19 January 2026