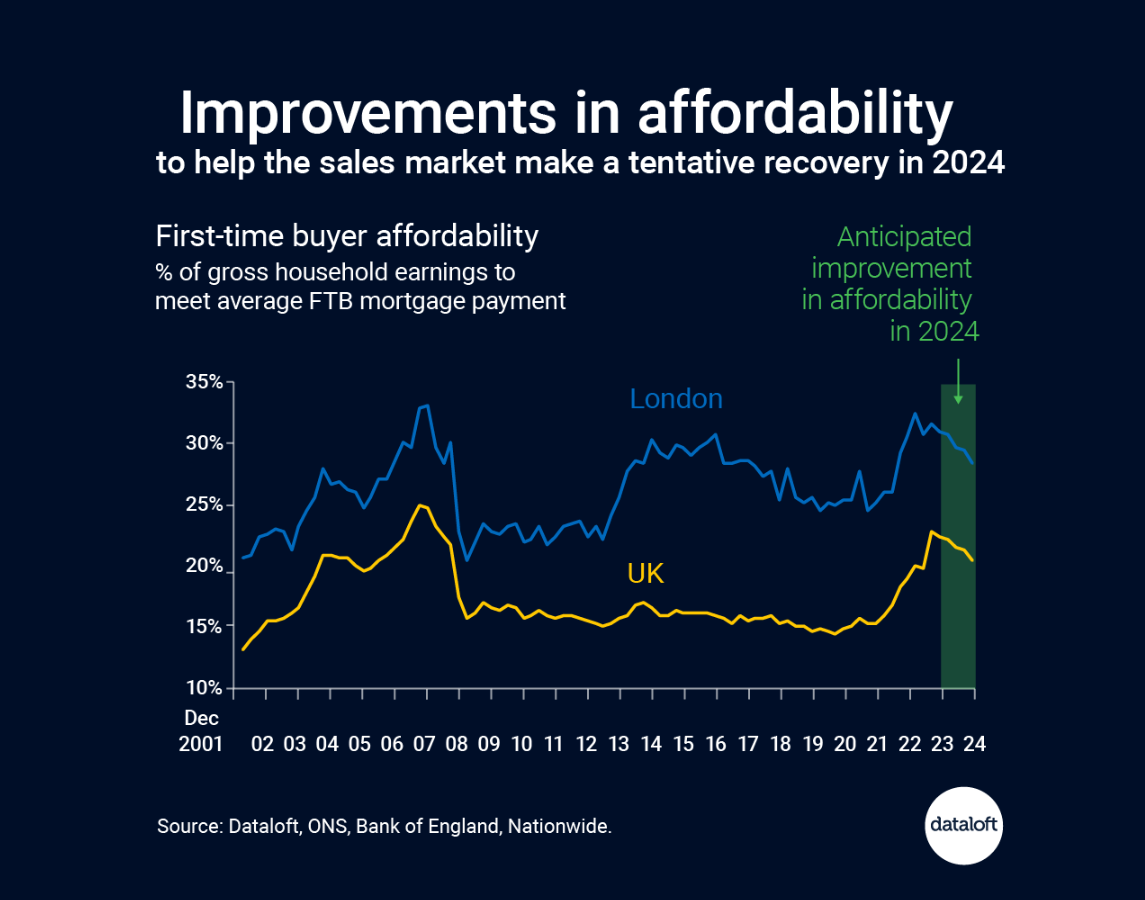

The team at Quealy & Co, head quartered in Sittingbourne but active across North Kent, are delighted to report on the anticipated improvement in affordability in 2024.

Comparing affordability levels through time helps us understand when a market needs to slow down (affordability is overstretched) or when a recovery can take hold (improved affordability).

A combination of factors ( largely due to the expectation of lower mortgage rates in 2024 especially following this week’s news that inflation had fallen further that anticipated to 3.9%) will see affordability improve.

Lower recent 5-year swap rates (4.4% at the end of November) point to further improvement in mortgage rates.

Affordability, as measured here, represents the proportion of household earnings it takes to meet mortgage payments.

Need mortgage advice? Quealy & Co Financial Services are independent mortgage brokers, established over 20 years, with two highly experienced advisers. We have access to whole of market and can confident secure the best deals available to suit your individual needs. Click here for contact details or here to see the latest mortgage deals.

REMEMBER: YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Source: #Dataloft, ONS, Bank of England, Nationwide. Affordability is based on FTB prices, assuming 1.5 full time incomes per household; 80% loan to value and average new lending mortgage rate; forecast earnings growth of 3.4% for 2024; average new lending rate to improve to 4.5% by end 2024; FTB price fall of -1% for remaining quarter of 2023 and then stabilised.

Other Stories

23 January 2026

Ski-In, Ski-Out Living at L’HÉRITAGE, Morzine

19 January 2026

by

by