Faversham's rental market through 2024 presents a compelling narrative of stability and strategic opportunity. Our analysis reveals patterns that matter for investors, landlords, and tenants alike as we navigate 2025's market dynamics.

Market Summary

The past year saw average rents stabilise at £1,163 monthly, reflecting 3% annual growth. This moderate increase, coupled with shifting property type dynamics and strong demographic factors, creates a nuanced market landscape worth exploring.

Key insights that shape today's market:

- Houses showed exceptional five-year growth at 42.13%

- Flats comprise 39% of lettings, with recent price adjustments

- Young professionals (25-29) represent 20% of renters

- Mid-market properties dominate current availability

Detailed Market Analysis

House Market Performance

The robust performance of houses, averaging £1,263 monthly, reflects strong family home demand in Faversham's evolving market. This figure, when viewed alongside the impressive 42.13% five-year growth trajectory, signals sustained market confidence and growing preference for larger living spaces. The trend appears driven by changing work patterns, with more professionals seeking home offices, and families prioritising additional living space over city-center proximity.

Property-type segmentation reveals a nuanced market structure that caters to diverse tenant needs while maintaining strong rental yields across all categories. The distribution of rental values across different house types tells an important story about market preferences and investment opportunities.

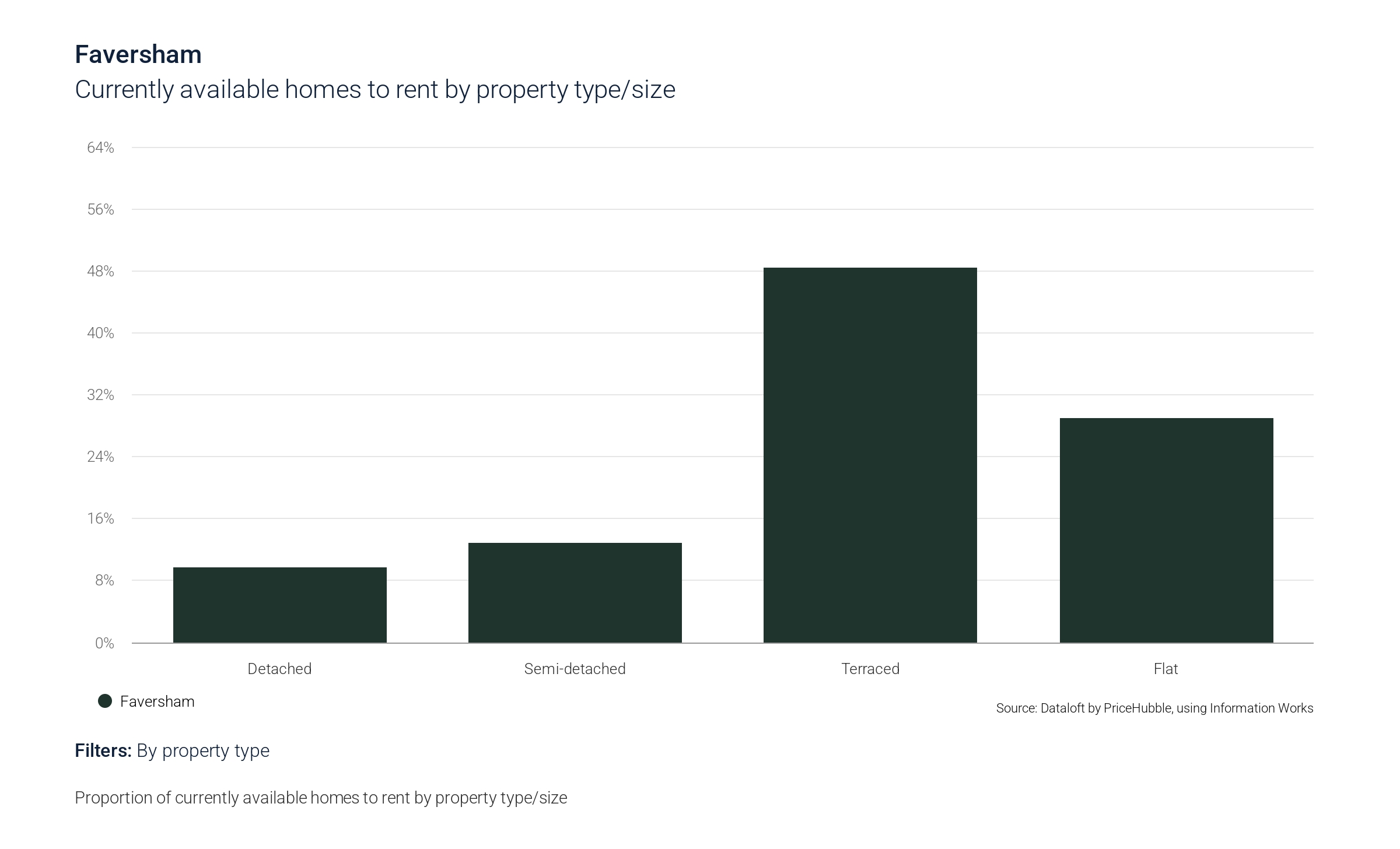

Detached homes (£1,500/month): Current market dynamics show detached properties commanding the highest rental values, positioned £237 above the overall house average. At 9.8% of available stock, these properties represent a premium yet scarce segment of the market, suggesting:

- Premium positioning attracts quality, long-term tenants

- Limited availability maintains strong rental values

- Potential for further value growth due to supply constraints

Semi-detached properties (£1,332/month): Occupying a sweet spot in the market at 12.90% of availability, semi-detached homes demonstrate strong appeal to family renters while offering landlords reliable returns. The £69 premium over average house rents suggests:

- Balanced value proposition for both landlords and tenants

- Strong appeal to family renters seeking garden space

- Optimal blend of affordability and space

Terraced houses (£1,194/month): Dominating the market at 48.39% of available stock, terraced properties form the backbone of Faversham's rental housing. Their popularity reflects:

- Consistent demand from diverse tenant groups

- Attractive yields for investors due to lower entry costs

- Strong appeal to young families and professional couples

This segmentation highlights a well-structured market where each property type serves a distinct tenant demographic while maintaining healthy rental yields. The substantial presence of terraced houses provides market stability, while limited availability of detached homes supports premium rental values in that sector.

Flat Market Dynamics

The flat sector in Faversham presents a particularly intriguing narrative as we enter 2025. While the overall market shows a modest 4.08% price adjustment from previous year levels, with current averages at £1,013 monthly, this shift reveals deeper market dynamics worth exploring. Representing 39% of all lettings, flats form a crucial component of Faversham's rental landscape, especially for young professionals and first-time renters.

Entry-Level Market: Studios and One-Bedroom Units The entry-level segment shows careful price positioning that maintains accessibility while ensuring landlord returns. Studios, averaging £798 monthly, establish the market entry point and serve a vital role in Faversham's rental ecosystem.

One-bedroom units command a £116 premium at £914 monthly, reflecting the value placed on separate living space. This segment's strength is particularly noteworthy given that 20% of Faversham's renters fall within the 25-29 age bracket.

The pricing structure suggests:

- Sustained demand from young professionals and solo renters

- Attractive entry points for first-time renters transitioning from shared accommodation

- Investment opportunities with reliable tenant pools

- Strong appeal for landlords seeking consistent occupancy rates

Premium Flat Market: Two-Bedroom and Larger Units The larger flat sector demonstrates interesting value progression, with two-bedroom units achieving £1,068 monthly and three-bedroom-plus configurations reaching £1,296. This £228 premium for additional bedrooms reflects:

- Growing demand for larger flat configurations

- Strong appeal to professional sharers and small families

- Competitive positioning against smaller houses

- Potential for optimised yields through multiple occupancy

The recent price adjustment in the flat sector, rather than indicating market weakness, suggests a natural correction that enhances market accessibility. This recalibration positions flats competitively against houses, which is particularly important given the strong five-year growth in house rentals. For investors, this presents strategic opportunities to enter the market or expand portfolios at attractive price points while maintaining healthy yields.

Faversham's Rental Market Distribution

Faversham's rental market demonstrates a well-structured pricing pyramid that supports both investment opportunities and tenant mobility. The foundation comprises 25% entry-level properties (£750-£1000), providing essential market accessibility, while a dominant mid-market segment (£1000-£1,250) at 43.75% forms the market's core.

The upper-mid sector (£1250-£1500) represents 18.75% of properties, transitioning into a premium segment (£1750-£2000) at 9.38%. A select 3.13% of properties above £2000 indicates Faversham's capacity to sustain luxury rentals.

This distribution, highlighted in our Faversham area guide, suggests a mature market with clear progression pathways and diverse investment opportunities for those seeking properties to rent in Faversham.

Market Implications for 2025: A Dual Perspective

The Faversham rental market presents distinct opportunities for investors and landlords as we progress through 2025. The substantial 42.13% five-year growth in house prices signals strong market fundamentals for investors, while recent flat market adjustments create strategic entry points. The dominant mid-market sector, combined with a growing young professional demographic (20% aged 25-29), suggests reliable occupancy rates and sustainable returns.

For landlords, the market structure encourages strategic portfolio diversification across property types. The premium sector's limited 12.51% availability indicates growth potential, while consistent demand for terraced properties ensures stable returns. Notably, the significant young professional tenant base emphasises the importance of modern amenities and high-quality finishes to maximise rental values and minimise void periods.

These insights, drawn from our latest Faversham area guide, underscore a mature market offering diverse opportunities for property investment and long-term growth.

Market Outlook: Navigating 2025

Faversham showcases a remarkable balance entering 2025, with sustainable growth across diverse rental property segments. The market's maturity is evident in its well-distributed portfolio, from starter homes to premium residences, while demographic trends signal continued vitality. This stability and Faversham's enduring appeal create opportunities aligned with varied investment horizons and lifestyle goals.

Connect with Quealy & Co Estate Agents in Faversham for guidance on rental market opportunities and to discover ideal properties to rent in Faversham Our dedicated team offers personalised insights to support your property journey.

Other Stories

23 January 2026

Ski-In, Ski-Out Living at L’HÉRITAGE, Morzine

19 January 2026

by

by