Welcome to the Quealy & Co August Property Market Update, where we turn the spotlight on the UK housing market over the last month. Through insights from Rightmove, Zoopla, and Halifax, we'll explore price trends, buyer interest, and more as we move into the late summer season.

House prices maintain their ground amidst the seasonal pause

Come July, house prices held their ground, notwithstanding the usual summer slowdown. According to Halifax, the average UK house price stands at £296,000, marking a 2–3% hike from last year, showcasing market resilience.

Nationwide observed a 0.6% uptick in July prices, with a yearly growth of 2.4%. Even though Rightmove reports a 1.2% dip in asking prices due to increased supply and holiday distractions, rest assured, it's not a sign of market stress.

Right now, there are 363 homes up for grabs in ME9, with an average asking price of £478,013. Over the last year, homes have sold for an average price of £356,792. Wondering about the price per square foot? It's currently at £350/sqft.

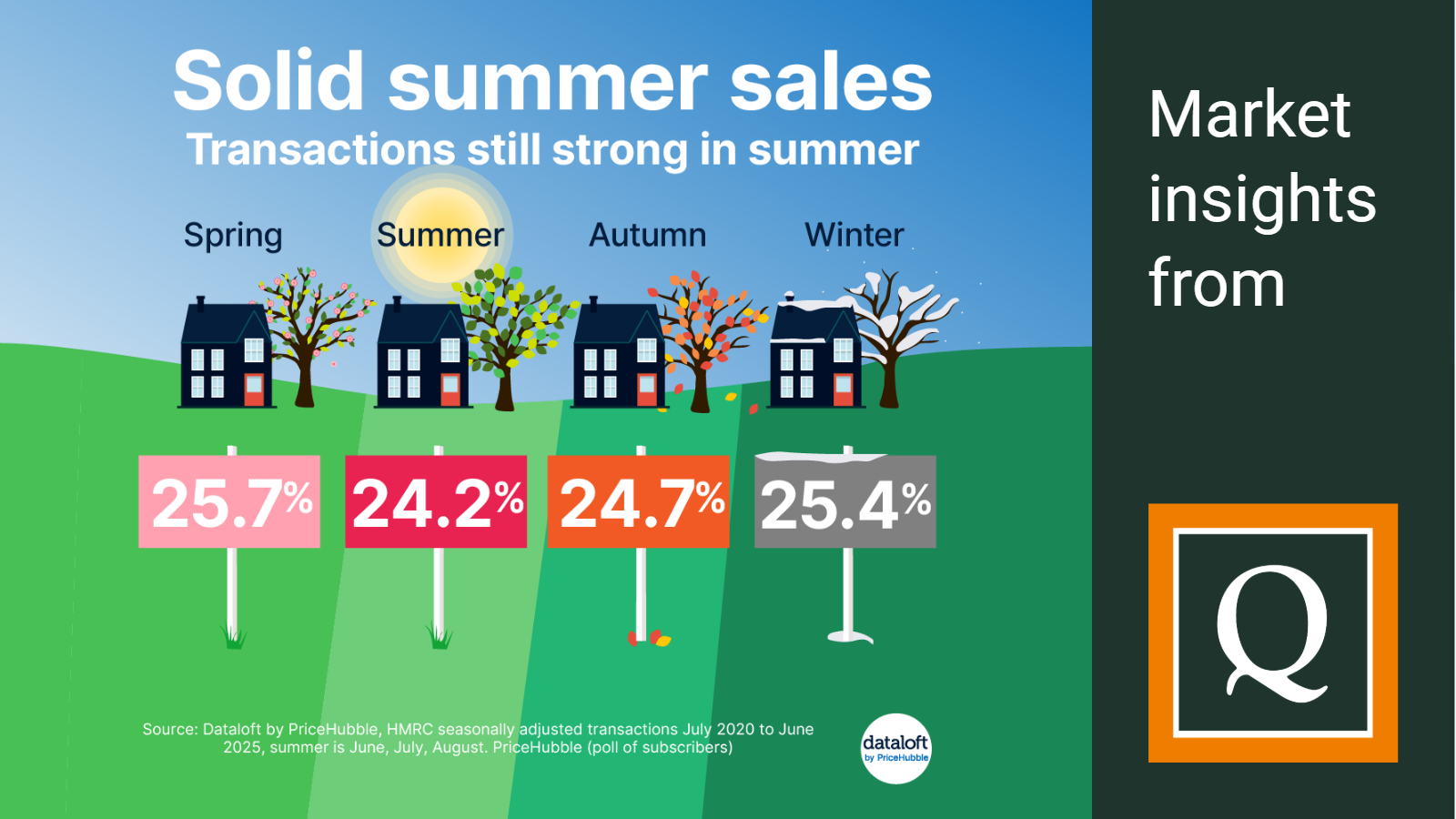

Solid summer sales!

The property market often experiences a summer slowdown due to holidays and school breaks. This year, 43% of agents observed a slowdown, while 25% did not notice any change. Over the past five years, summer transactions have averaged 292,680, only 2% less than the autumn average, accounting for 24.2% of annual activity. This highlights the market's resilience despite a slight seasonal dip.

Buyer demand defies the summer lull

Buyer interest is buzzing! Zoopla notes an 11% yearly increase in enquiries, while Rightmove tracks a 6% rise in early July. Sales activity has climbed 5–8% year-on-year, thanks to better affordability and a market that's welcoming to buyers with more options and negotiable prices. With low unemployment and rising wages boosting buyer confidence, we're seeing demand maintain strong levels historically.

More homes on the scene boost choices for buyers

This year, we've seen a swell in homes up for sale, with listings up 12% compared to last year. This breadth of choice means a less competitive atmosphere for buyers. Such increased supply helps moderate price hikes and keeps transaction volumes healthy, paving the way for a balanced market.

Easing mortgage rates enhances affordability

Good news for July - mortgage rates are easing! With the Bank of England's base rate at 4%, and average two-year fixed rates dropping to 5%, many are seeing monthly mortgage savings. More relaxed affordability assessments are stretching borrowing power, further boosting the confidence of buyers.

Summary: A market on the mend, not in decline

In July 2025, the UK property market shows resilience with steady house prices, solid buyer interest, and a growing supply of homes. While we anticipate modest price growth around 1–2% and lower interest rates, the outlook is bright and the market’s adaptability inspires optimism.

Thinking of Moving Home in Kent?

Quealy & Co. is here to keep you informed with our monthly property market updates. Want a local house price report specific to your area? Just give us a ring at 01795 429836 or drop us an email at hello@quealy.co.uk. We’re happy to send you one for free.

For a quick online valuation of your home's market value, whether you're selling or letting: Click here.

Other Stories

23 January 2026

Ski-In, Ski-Out Living at L’HÉRITAGE, Morzine

19 January 2026

by

by