January Sees the Biggest Price Jump on Record as Buyer Confidence Returns...

The UK property market has started the year with a bang. January has delivered the largest ever price increase for the month, signalling renewed confidence from both buyers and sellers after a period of uncertainty.

According to the latest data from Rightmove, the average price of homes coming to market in January rose to £368,031 – a 2.8% increase on December, equivalent to nearly £10,000 in just one month. This is the biggest monthly rise seen since June 2015.

What’s driving the surge?

Several factors are coming together to fuel this strong start to the year:

- Market sentiment has rebounded following the Budget, giving movers more confidence to act

- The traditional Boxing Day bounce returned with force, with Rightmove recording its busiest ever Boxing Day for website visits

- Buyer demand jumped by 57% in the two weeks after Christmas, while new listings surged by 81%

- Mortgage affordability has improved, with average two-year fixed rates now at their lowest level since before September 2022

Nationally, average property prices are now 0.5% higher than this time last year, marking a clear shift in momentum.

Spotlight on Sittingbourne

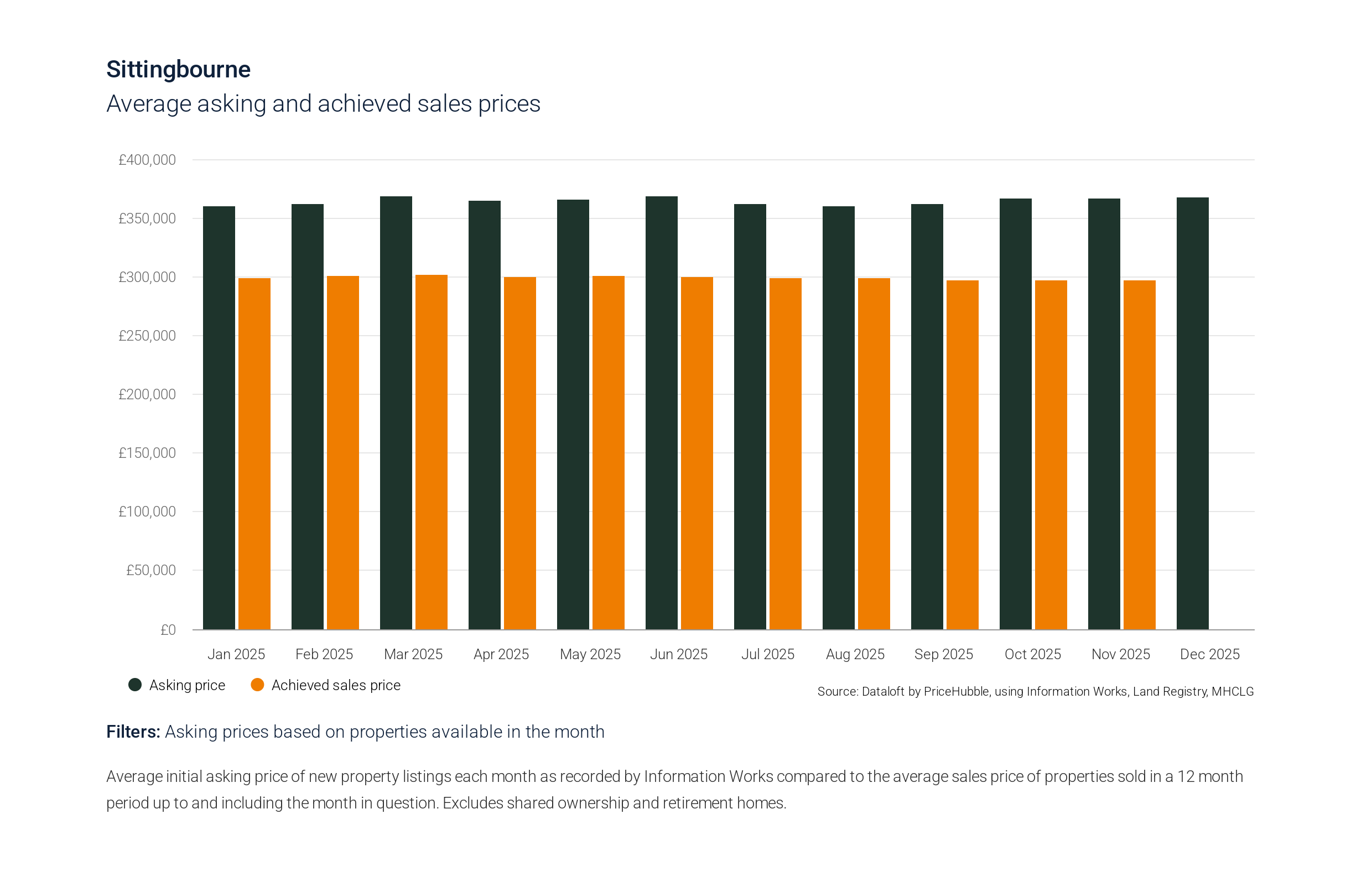

In Sittingbourne, getting the asking price right from day one is proving crucial. While the average asking price of homes currently for sale is £359,801 (£361 per square foot), properties that have successfully sold over the last 12 months achieved a lower average of £296,682, or £333 per square foot.

With 27.3% of homes already reducing their price after launch, it’s clear that buyers are price-sensitive and well informed.

A word of caution for sellers

While headline price growth is encouraging, it’s not a green light to overprice.

The number of homes available for sale is currently at its highest level for this time of year since 2014, and around one in three existing listings has already seen a price reduction. This means buyers still have choice – and pricing realistically remains crucial to achieving a successful sale.

For homeowners in North Kent, this creates a balanced but competitive market. Well-priced homes are attracting strong interest, while optimistic pricing risks delays and reductions later on.

What does this mean if you’re moving in 2026?

It’s early days but there are encouraging signs that more home-movers are now planning a 2026 move as we head towards the important Spring buying and selling season.

Compared with the stamp-duty-fuelled rush at the start of last year, buyer demand is calmer but healthier and more sustainable. With greater clarity on finances and improved mortgage rates, many buyers are planning moves with confidence rather than urgency.

For sellers, this is an excellent time to test the market – if you start with the right price.

Thinking of selling your home in North Kent?

Whether you’re considering a move this year or simply want to understand what your property could achieve in today’s market, accurate pricing is key.

👉 Book a free, no-obligation property valuation with Quealy & Co and get expert local advice tailored to your home and location:

https://www.quealy.co.uk/properties-valuation

If you’d like to talk things through, contact our team on 01795 505754 or email hello@quealy.co.uk. We’re here to help you move home with confidence.

Other Stories

12 January 2026

2026: The Year Moving Home Feels Possible Again

05 January 2026