First time buyers benefit the most from Help to Buy

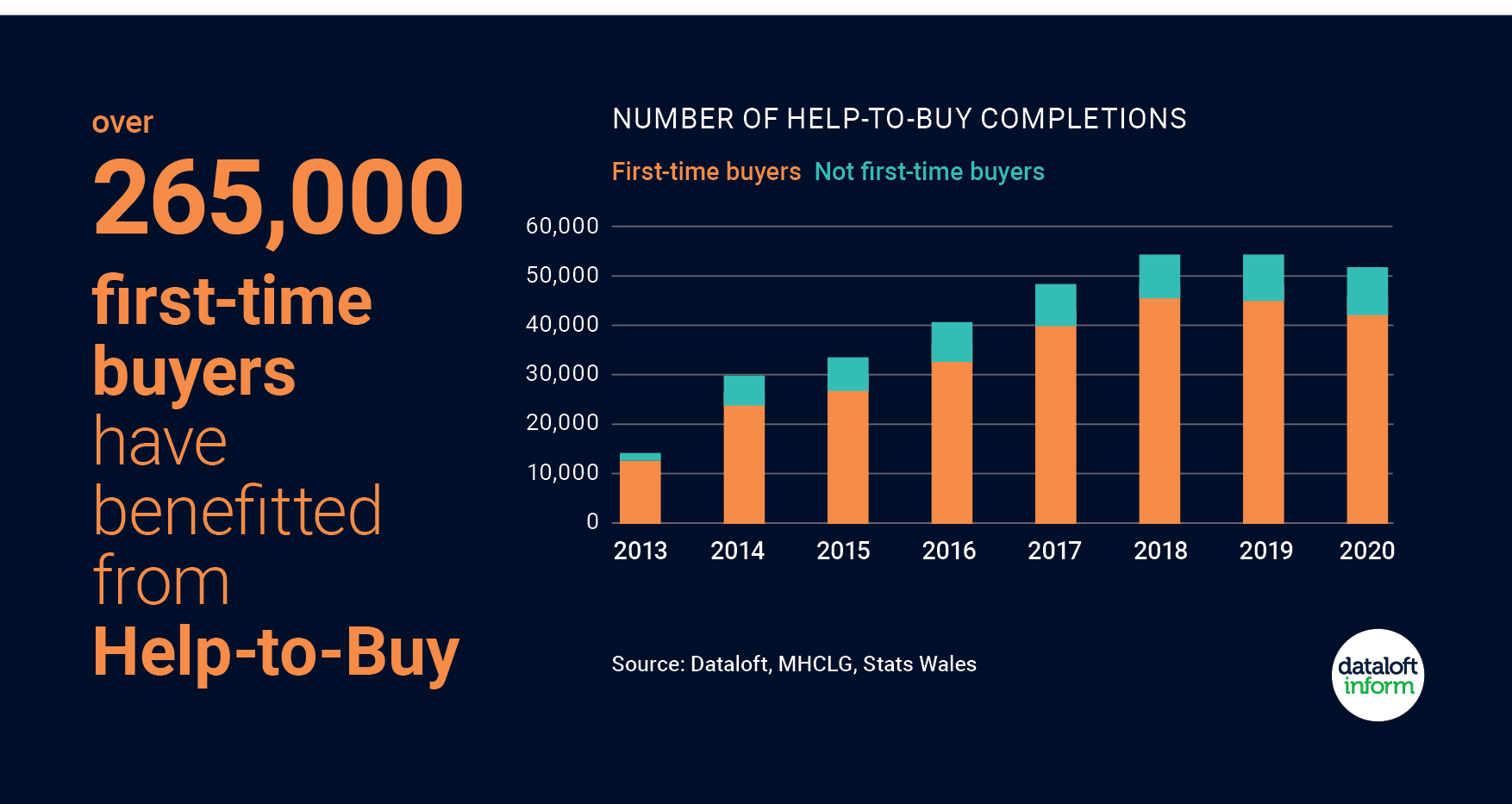

Over 265,000 first-time buyers in England and Wales have benefitted from government the Help-to-Buy Equity Loan schemes since they were introduced in April 2013 and January 2014 respectively.

82% of all Help to Buy equity loan property purchases between April 2013 and December 2020 have been to first-time buyers.

Over half (58%) of first time buyers in England purchase their property with the minimum 5% deposit. 23% have a deposit between 5.1% and 10%. In England, the average first time buyer Help to Buy property price is £311,635; £50,000 less than for non-first-time buyers.

Despite the property market closure due to the first national lockdown in 2020, first time buyer Help to Buy purchases were just 5% lower than in 2019. 17,700 completions took place in the final quarter, virtually double the 5-year quarterly average (2015–2019).

Are you looking to buy your first home in North Kent?

Quealy and Co Estate Agents have a fantastic collection of first time buyer properties for sale in the Sittingbourne area. Click here to browse all our houses and apartments for sale.

Are you looking into buying your first home but don’t know where to start? Our friendly team are just a phone call away and are happy to answer any questions you have about buying a property and the various Help to Buy Equity Loan schemes that could be applicable to you.

Call us on 01795 429836 or email hello@quealy.co.uk

Source: Dataloft, MHCLG, Stats Wales

Other Stories

18 December 2025

Quealy & Co Christmas Opening Hours 2025

15 December 2025

Property Of The Month: Park Avenue, Sittingbourne

14 December 2025

Saltwood Manor: A Landmark New-Build Home on the Kent Coast

11 December 2025