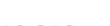

UK interest rates were raised for the fourth time since December (on 5th May 2022), by a quarter of a percentage point to 1%. This is the fastest increase in borrowing costs in 25 years.

Inflation is running at 7%, which is more than three times its target and is still rising. This is due to the post pandemic-surge in consumer demand and has been exacerbated by the Russian invasion of Ukraine.

The consensus among a poll of economists by Reuters is that the base rate will rise to 1.5% by early 2023, but will remain there for the rest of that year. This remains low by historic standards.

Many borrowers will be cushioned from any immediate impact by fixed-rate deals. The proportion of advances on such deals has risen each quarter since the market reopened in June 2020 (94.5% Q4 2021, FCA).

Get the best mortgage deal for your needs

Get in touch with Quealy & Co Estate Agents today who can arrange a free, no-obligation chat with our independent financial advisors. Advisors have access to the best deals on the mortgage market and will ensure you get the best price available for your property needs.

Call us on 01795 429836 or email hello@quealy.co.uk to chat with a member of our friendly and experienced team about anything to do with moving home.

Other Stories

23 January 2026

Ski-In, Ski-Out Living at L’HÉRITAGE, Morzine

19 January 2026