Quealy & Co, your expert estate agent in Sittingbourne and the surrounding areas, take a look at the UK hotspots for second homes. Although second homeowners are still in the minority, the number of people in the UK who have bought another property has increased dramatically over the past few decades, with over 10% of British adults now owning a second home.

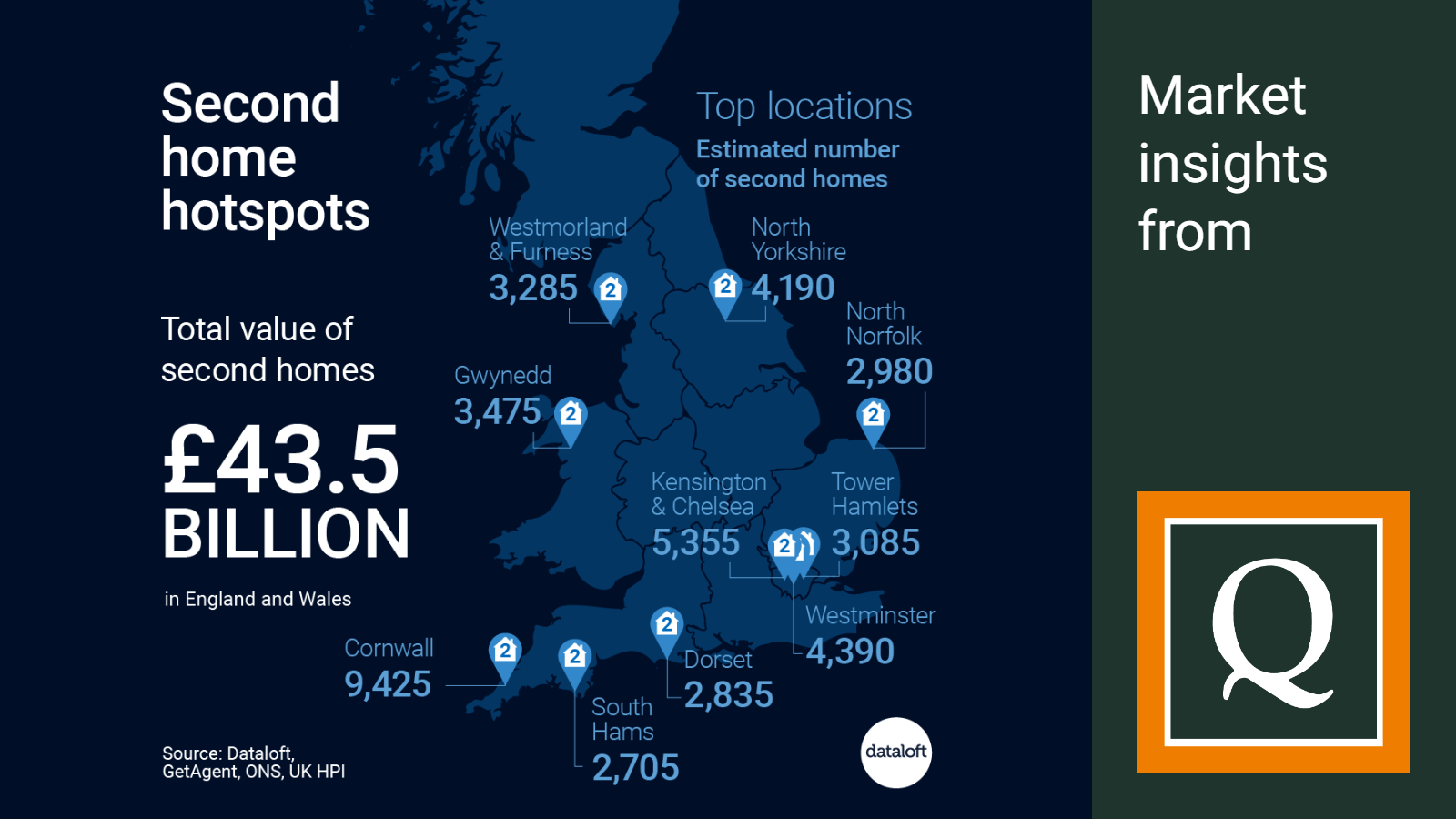

Cornwall has been ranked as the top hotspot in the UK for second homes, with 9,425 currently located there. Kensington and Chelsea came second with 5,355, and Westminster third with 4,390.

Kensington and Chelsea tops the charts for the highest total value of second homes at £6bn, followed by Westminster (£4.2bn) and Cornwall (£3.1bn).

Despite flats making up 42% of all second homes, detached houses hold the greatest market value, with £15.9bn.

Only 24% of second homes are used solely for that purpose, with the vast majority (69%) rented out. Second home ownership is a contentious subject in some areas, but supporters point out the contribution visitors make to these local economies.

Why Do People Purchase Second Homes?

Everyone has their own reason for buying multiple properties but the three main reasons why people purchase second homes are:

- As an investment. The private rental sector represents a great investment opportunity for prospective landlords, so it isn't too surprising that one of the main reasons for buying another property is as an extra form of revenue.

- As a holiday property. Whether in the UK or abroad, buying holiday homes is becoming increasingly popular.

- For somebody else. Buying a property for a family member, typically a child, may be a less popular reason to purchase a second home, but it happens fairly often.

How Can I Buy A Second Home?

There are several ways in which you can buy another property in Kent or further afield, including securing a second mortgage, buying with cash, or using the equity you have in your existing home.

Although some people believe that homeowners must pay off their mortgage before they obtain another, this isn't the case. It's possible to have two concurrently running mortgages. You will, however, have to be able to show you're able to afford a second mortgage, have an excellent credit rating, and have a large deposit available.

If your existing property already has plenty of equity, it's possible to release it by remortgaging and then using the money to cover some or all of your new purchase.

You can use our instant online valuation tool if you want a ball park figure of your home's value to find out how much equity you could release for a second home: Click here.

Which Other Costs Should I Consider When Purchasing A Second Home?

As well as the cost of buying a second home, there are some extra costs to bear in mind. The most significant is the stamp duty levied on second properties, which at present stands at 3% of the purchase price. There is also Capital Gains Tax to pay when selling a second home, although that may not be too much of a concern depending on when, or if, you're planning on selling up. Don't forget, too, that council tax must be paid on second homes, although if you're planning on renting out the property, the tenants can take over responsibility for making the payments.

Where Can I Get More Advice About Buying Second Homes?

If you're considering buying a second home in Kent or further afield, the experienced team at Quealy & Co is on hand to give you all the advice and information you need. We can help you find your perfect second home, so give us a call on 01795 429836 or email hello@quealy.co.uk.

Source: #Dataloft, English Housing Survey, data for 2021–2022, GetAgent, ONS, UK HPI

Other Stories

18 December 2025

Quealy & Co Christmas Opening Hours 2025

15 December 2025

Property Of The Month: Park Avenue, Sittingbourne

14 December 2025

Saltwood Manor: A Landmark New-Build Home on the Kent Coast

11 December 2025

by

by