As we head towards the end of the year (and with Budget uncertainty finally behind us), many buyers and sellers are feeling ready to move forward again. The removal of the proposed annual property tax from 210,000 homes has lifted a major concern for higher-value areas, giving the property market a welcome boost. However, with no stamp duty reform in sight, moving costs remain a key consideration for anyone planning their next step.

At Quealy & Co, your trusted estate agents in North Kent, we’ve taken a close look at the latest data to bring you a clear, friendly overview of what’s happening in the property market this December. Whether you’re planning a move in 2026, thinking of selling in Kent, or gearing up to buy your first home, here’s what you need to know as 2025 draws to a close.

House Prices: A Gentle Cooling in the South

Zoopla reports that the average UK house price now sits at £270,200, up 1.3% year-on-year, a modest rise of £3,340.

Across southern England, however, prices have dipped slightly for the first time in 18 months. For buyers, this is encouraging news, opening up new opportunities. For sellers, it’s a signal to price strategically as the market finds its rhythm following a quieter autumn influenced by Budget speculation.

Seasonal Slowdown Arrives Early

The usual winter slowdown has kicked in a little sooner this year, likely due to the Budget falling so close to Christmas. Buyer demand is currently 12% lower than last autumn, but the market remains far from sluggish.

Sales agreed are only 4% down year-on-year, showing that serious buyers are still out there with many of them keen to secure a deal before the year ends. Think of it as the property world’s version of getting your Christmas shopping done early!

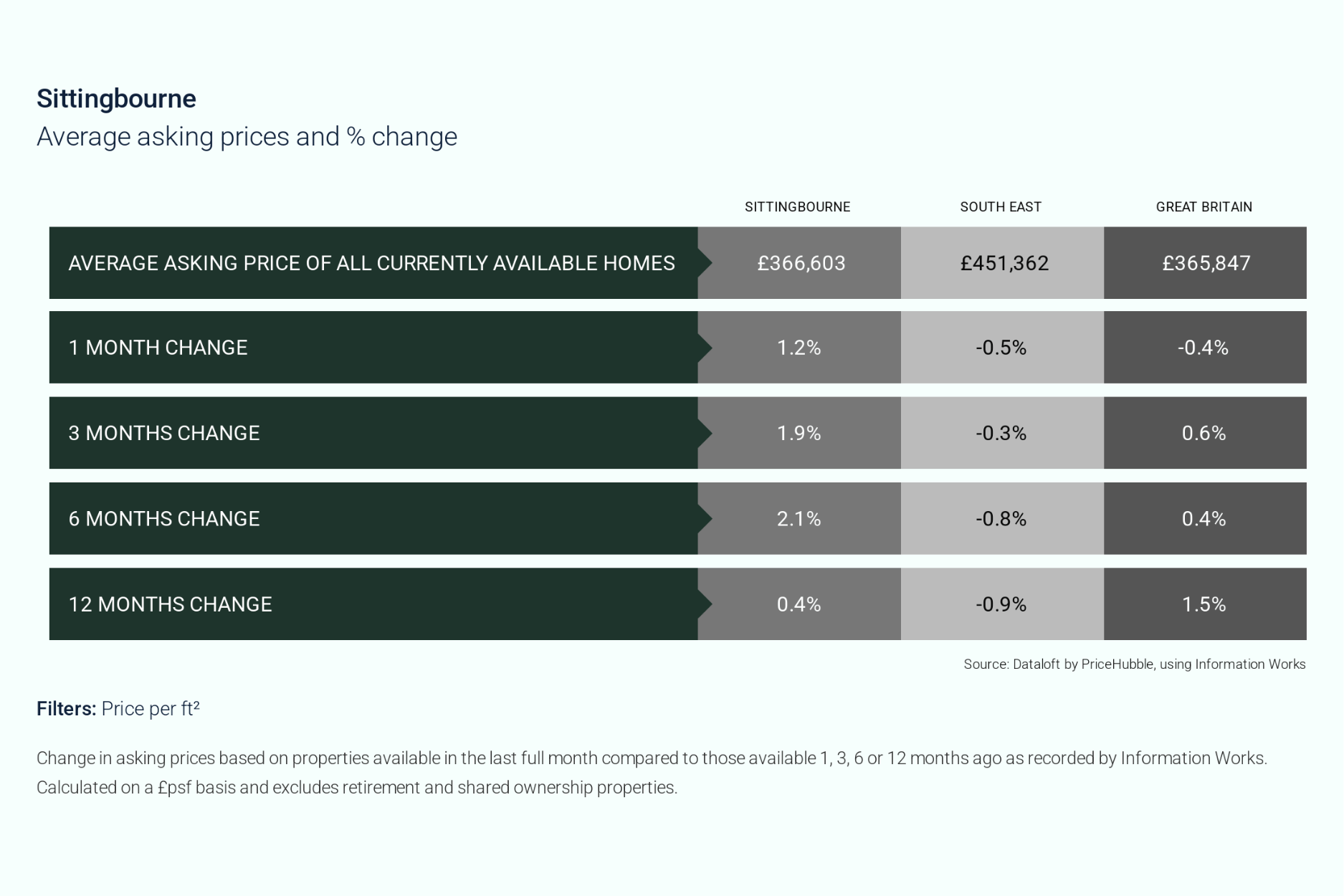

Spotlight on Sittingbourne

Sittingbourne continues to shine for both buyers and sellers. As of November 2025:

- The average asking price is £366,603 (£362 per sq. ft.)

- The average sold price over the past 12 months is £298,388 (£332 per sq. ft.)

A notable 24.9% of homes currently for sale have reduced their price, creating real opportunities for proactive buyers.

For sellers, the message is clear: well-presented homes priced realistically are attracting motivated buyers and selling well.

Housing supply and demand in Sittingbourne remain well balanced as we approach the end of the year. There are currently 894 properties for sale, a slight 2.9% decrease on last year, suggesting a marginally tighter supply. At the same time, homes are selling more quickly: properties sold in the past month were on the market for an average of 41 days, which is nearly 20% faster than a year ago.

This combination of steady demand and reduced availability reflects a market where well-priced homes attract swift attention from motivated buyers.

Mortgage Rates: A Glimmer of Festive Cheer?

Those keeping an eye on mortgage options will have noticed rates improving over the past month. Several major lenders have made reductions, with one announcing a 3.51% two-year deal, marking the most competitive rate on the market when this article was written.

If this trend continues, we could see rates slipping below 3.5% by Christmas, giving buyers and those remortgaging in Kent a welcome confidence boost as we head into 2026.

Looking Ahead: Early 2026 Property Market

After months of speculation, the Budget turned out to be far gentler on the housing market than many feared. This clarity is already helping the market settle, with buyers and sellers regaining the confidence that was lost during late summer’s uncertainty.

The desire to move remains strong, it simply needed direction. With that now in place, we expect activity across Kent to steadily rise in early 2026, as households who paused their plans begin to re-enter the market with renewed enthusiasm.

Want To Move Home In 2026?

If you're thinking about making a move, whether buying, selling, or simply exploring your options, then the Quealy & Co team is here to guide you with straight-talking advice and local expertise.

Contact Quealy & Co, trusted Kent estate agents, for expert advice and a < href="/properties-valuation">free property valuation.

We’re here to help you take your next step with confidence. Just give us a ring at 01795 429836 or drop us an email at hello@quealy.co.uk.

For a quick online valuation of your home's market value, whether you're selling or letting: Click here.

Disclaimer: All data and market information referenced in this update is correct as of 9th December 2025. It is provided for general guidance only and should not be relied upon as financial or legal advice. We recommend seeking professional advice tailored to your individual circumstances before making any property-related decisions.

Other Stories

23 January 2026

Ski-In, Ski-Out Living at L’HÉRITAGE, Morzine

19 January 2026

by

by