During June and into early July, we’ve seen the UK property market continue on its path of cautious optimism. While the fast growth seen in previous years has eased, a sense of stability is emerging, underpinned by rising buyer demand and a potential shift in interest rates.

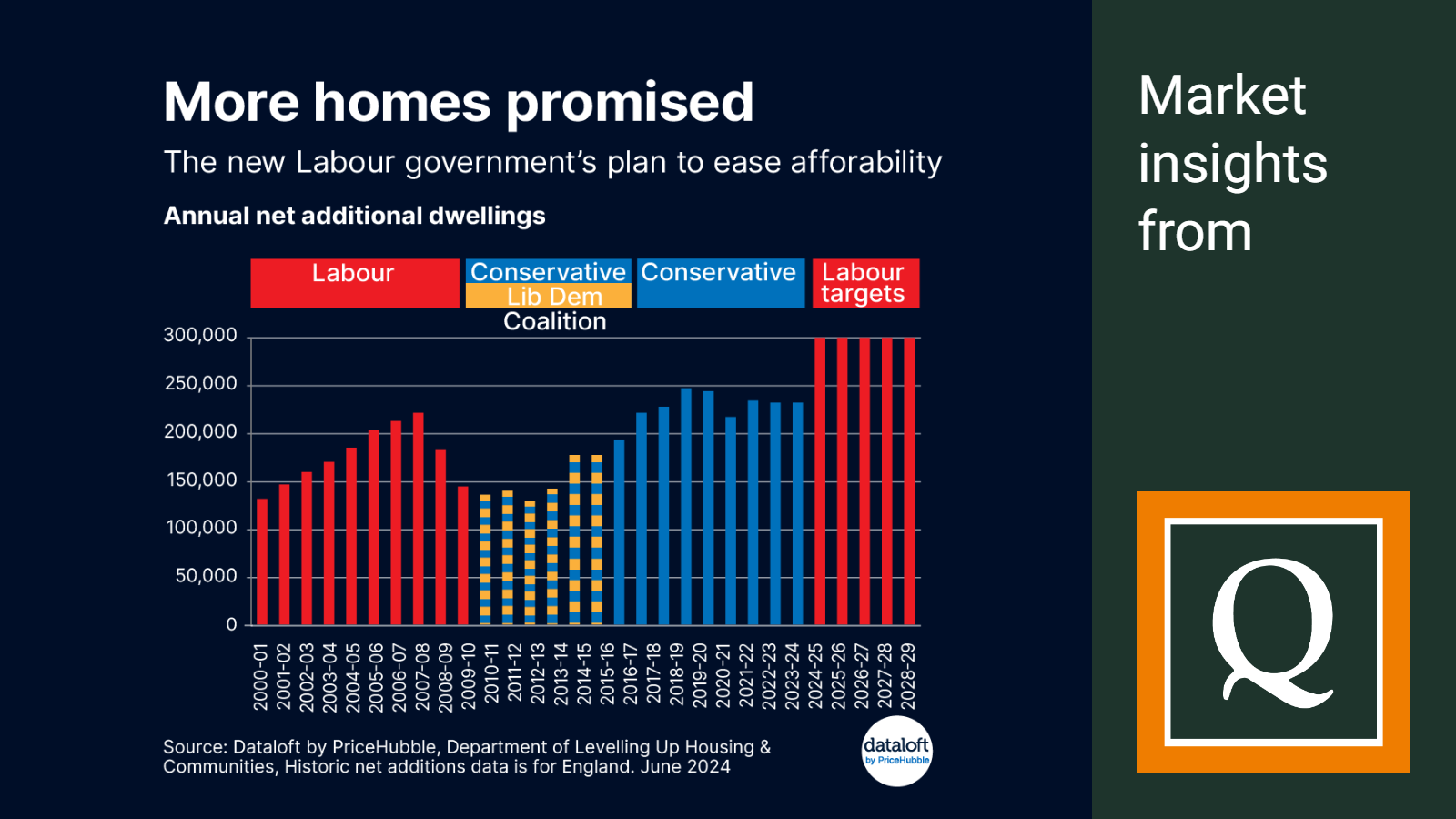

With Labour taking the reins of government, they have pledged to build 1.5 million homes in their first 5 years. This equates to 300,000 a year; in parallel with prior Conversative pledges. An increased supply of homes is critical for affordability for a generation of renters and would be buyers. Labour certainly has ambitious plans to reform planning, build a new generation of towns, devolve stronger powers to mayors and fast track approval for urban brownfield development.

We will bring more news on the new Government's decisions around housing and the property market next month. For now, let's delve into further key trends shaping the market this July, brought to you by our experienced property experts at Quealy & Co.

Market Recovery Gathers Momentum

The good news for buyers and sellers is that the property market is experiencing a steady recovery. After a period of uncertainty, house prices are showing signs of growth again. According to Nationwide Building Society, May 2024 saw a 0.4% increase in average house prices, bringing the annual growth rate to 1.3%. This indicates a market that's found its footing and is on an upward trajectory.

Regional Variations Remain

While the national picture is one of growth, it's important to remember that the UK property market is a patchwork of regional variations. Scotland continues to lead the pack with a significant 6.7% annual increase in house prices, while England and Wales are seeing more modest rises of 1% and 1.3% respectively. Northern Ireland has also shown steady growth of around 4%.

Understanding these regional differences is crucial for both buyers and sellers when making informed decisions. If you would like to know more about the property market in North Kent, please get in touch with our friendly team.

The Interest Rate Question

A significant factor influencing the market is the ongoing speculation around interest rates. With inflation falling closer to the Bank of England's 2% target, a potential base rate cut is on the horizon. This could be a game-changer for the market, making mortgages more affordable and potentially boosting buyer demand. Economists predict the first cut could come as early as August 2024. The impact of this on house prices remains to be seen, but it's likely to contribute to a more vibrant market.

Election Jitters or Business as Usual?

Many commentators wondered if the market would stall in the build up to last week’s election. However, experts suggested it was unlikely to happen given that whatever the outcome of the election no dramatic changes impacting the housing market were being proposed. We experienced nothing other than the usual seasonal adjustment in June and if anything this week’s announcement around the reintroduction of housing targets and relaxation of planning policy the impact on activity in the housing market is likely to be nothing other than positive

Supply and Demand: Finding Balance

The good news for buyers is that there are signs of a healthy increase in the number of properties coming onto the market. This increased supply is expected to keep house price inflation in check throughout the year. While significant price hikes might be off the table for now, the steady flow of properties ensures buyers have more options in a balanced market.

What Does This Mean for You?

Landlords:

The rental market continues to see high demand, with rents rising at a slower pace than the previous year. Zoopla reports an average increase of 6.6% for new lets in April 2024. While this presents an opportunity for stable returns, it's important to remember tenant retention is key. Focusing on good communication, responsive maintenance, and ensuring your property remains competitive in terms of rent and amenities will be crucial for attracting and keeping quality tenants.

Given Land Registry figures of average growth in the value of houses in the local area of 21.5% over the last five years and 73.4% over the last ten years the case is made for property investment being a valuable part of an investor’s overall investment strategy.

Buyers:

With a potential interest rate cut on the horizon, affordability might improve in the coming months. However, with increased competition due to rising demand, it's still a seller's market in many areas. Being prepared with a well-researched offer and a strong financial position will be key to securing your dream property in Kent.

Sellers:

While significant price rises are less likely, the market conditions remain favourable for sellers. At Quealy & Co, we suggest focusing on presenting your property in its best light through minor improvements, home-staging and competitive pricing to attract buyers quickly in a market with more options.

The Bottom Line

The UK property market is moving towards cautious optimism. House prices are showing signs of growth, with regional variations offering opportunities for both buyers and sellers. The potential for a base rate cut later this year could be a major driver of market activity. With an increased number of properties coming to the market, a sense of balance is emerging. Whether you're a buyer, seller, or landlord, staying informed and seeking expert advice will be crucial for navigating the market effectively.

Quealy & Co are your trusted independent estate agents in Sittingbourne, also covering Sheerness, Minster, Faversham, Canterbury, Rainham, Gillingham, Chatham, Rochester and Maidstone. We are delighted to bring you our property market updates each month.

If you are thinking of buying, selling or letting a property in North Kent, please get in touch for a no obligation chat. Call us 01795 429836 or email hello@quealy.co.uk

You can also use our instant online valuation tool if you want a ballpark figure of your home's value: Click here

Other Stories

23 January 2026

Ski-In, Ski-Out Living at L’HÉRITAGE, Morzine

19 January 2026

by

by