Quealy & Co Estate Agents, based in Sittingbourne, bring you the very latest news and information regarding house prices and the property market.

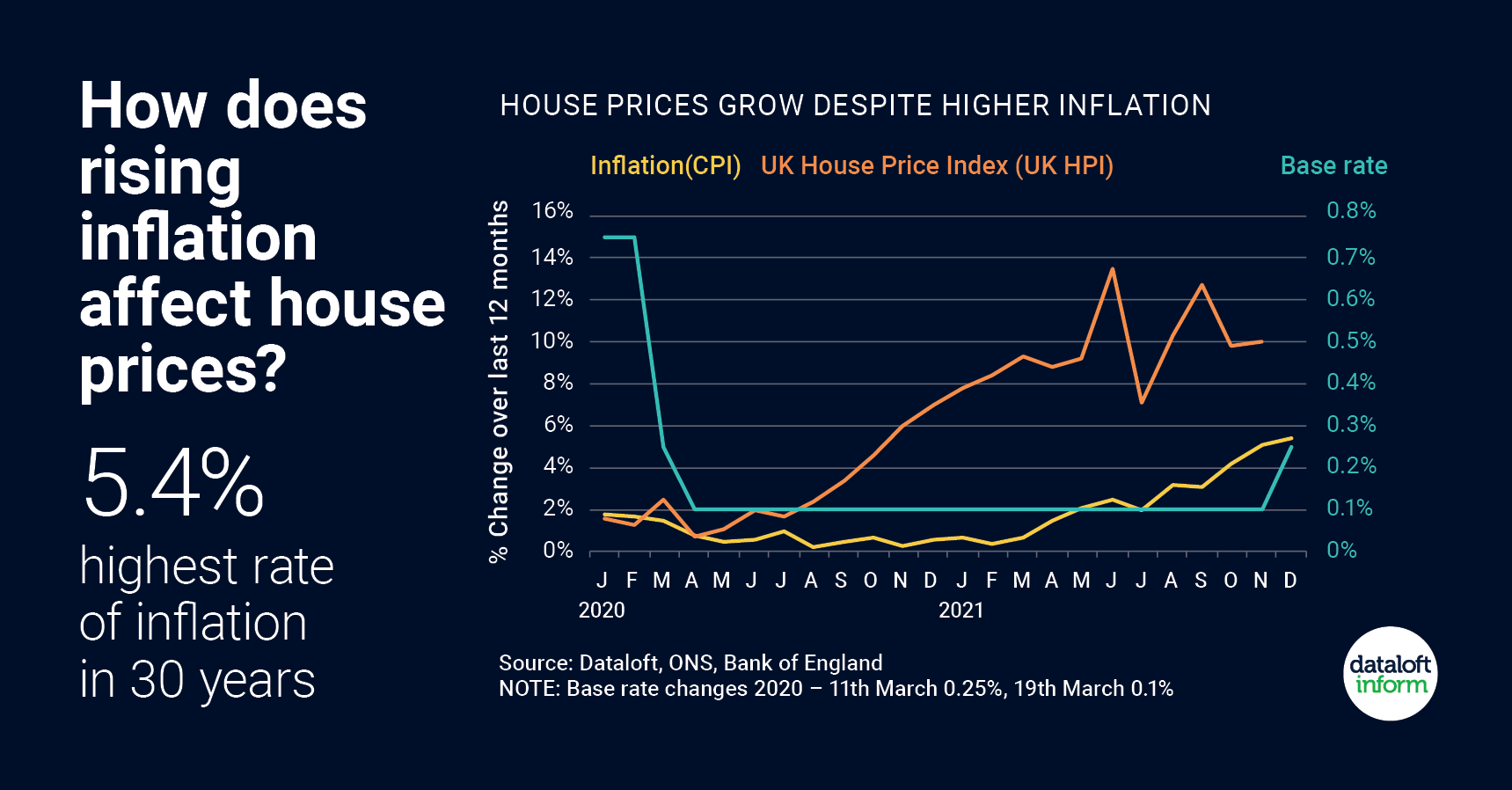

Recently, we discovered that consumer price inflation (CPI) has risen to 5.4% in the 12 months to December 2021. This is the highest rate in 30 years but is expected to fall back after an April peak.

Quealy & Co Estate Agents, based in Sittingbourne, bring you the very latest news and information regarding house prices and the property market.

Recently, we discovered that consumer price inflation (CPI) has risen to 5.4% in the 12 months to December 2021. This is the highest rate in 30 years but is expected to fall back after an April peak.

So how does rising inflation affect house prices?

Energy costs are a major component of price rises and this is likely to turn the spotlight on energy efficient homes. Back in September we wrote about how homes with an EPC rating A or B over the past year achieved a 10% price premium over properties with an EPC energy efficient rating of D. Read full article here.

The key driver of house prices and affordability is interest rates, which are expected to remain low in the long term, despite a small rise to 0.5% widely expected in February.

Other drivers of demand for housing, which are expected to continue, are lifestyle changes as we cautiously step away from pandemic restrictions, and deposits saved during the pandemic.

Are you thinking of moving in 2022?

If you own a property in Kent and need advice on any aspect of selling or letting your home, call us on 01795 429836 or email hello@quealy.co.uk to chat with a member of our friendly and experienced team.

Source: Dataloft, ONS, Bank of England

Other Stories

27 October 2025

NEWSFLASH: Renters’ Rights Bill Update October 2025

26 October 2025