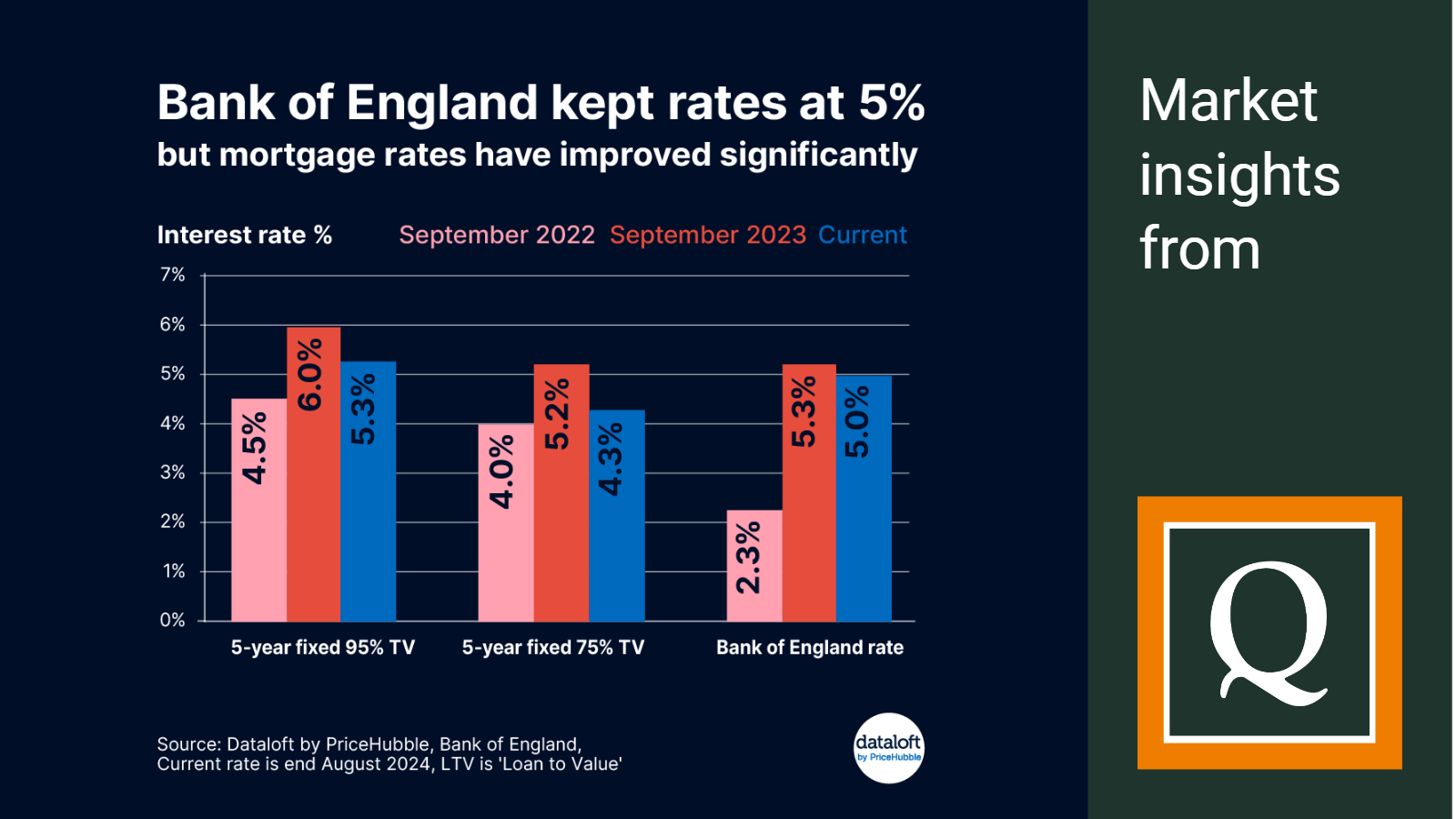

The Bank of England voted to keep rates at 5% in the September meeting, having cut them in August, stating more cuts are on the cards if inflation stays low. The latest consensus forecast for the Bank rate is to be 4.7% in Q4 2024, suggesting economists expect one more 25 basis point cut before the year end.

Mortgage rates have already fallen significantly, pricing in the potential for further interest rate cuts. A 5 year fixed mortgage (on a 75% LTV*) is now 4.3%, down from 5.2% a year ago and not far off the September 2022 rate (4.0%).

Increased competition in the mortgage market suggests rates will go even lower over the next few months and will be further supported by any further Bank of England cuts.

Notably the US cut interest rates this month: signalling that inflation was under control and that further cuts would be forthcoming.

For mortgage advice with no broker fees, book your mortgage appointment with Quealy & Co Financial Services Ltd.

01795 505761

*Your home may be repossessed if you do not keep up with your mortgage payments*

Quealy & Co Financial Services Limited is authorised and regulated by The Financial Conduct Authority. No: 919693.

Source: Dataloft by PriceHubble, Bank of England, HM Treasury Consensus Forecasts. *Loan to Value

Other Stories

16 February 2026

Next Level Marketing: Showcasing Your Home to the Right Buyers

16 February 2026

Your February 2026 Property Market Update

09 February 2026

by

by